Unpacking the High Stakes US-China AI Energy Race

The China-US Rivalry Heats Up Amid Trade War

If you flip to any major financial news channel recently, you’re likely to hear the latest in the trade war between the world’s two largest economies – China and the United States. After taking back the White House, President Trump quickly worked to even the massive trade imbalance between the two countries, leading to tit-for-tat tariffs, intensifying rhetoric, and volatile markets. However, while Wall Street is hyper-focused on the trade mayhem, many investors forget about what initially started the 2025 correction – the AI wars.

The DeepSeek Wake Up Call

In late January, a Chinese start-up dubbed DeepSeek launched its Chat-GPT-like large language model. According to DeepSeek, the company nearly re-created the performance of top American chatbots like Alphabet’s GOOGL – Free Report) ) Gemini and OpenAI and Microsoft’s MSFT – Free Report) ) ChatGPT. US markets would lose $1 trillion in market cap overnight, mostly from “Magnificent 7” stocks like Nvidia NVDA – Free Report) ).

Wall Street Analysts Debunk DeepSeek Claims

The plunge in the US stock market was caused by DeepSeek’s claims that it had “trained” its AI model for less than $6 million. However, a report from SemiAnalysis later debunked the claims, suggesting that DeepSeek’s hardware spend was “well higher than $500 million.”

China Vs. US: The Race for AI Supremacy

Though DeepSeek’s claims ended up being false, the incident should teach investors two critical lessons:

1. AI is Critical to the World Economy: The fact that one headline swung US markets by $1 trillion overnight shows how critical the race is for AI dominance. AI will have broad implications for defense and the two largest economies. Whoever wins AI will win the economic battle.

2. LLMs Require Massive Hardware Spend: If a company wants to create a competitive large language model, there is no other way than buying a massive data center and filling it with expensive hardware.

The second point is what we will discuss today.

Data Centers Require Massive Amounts of Energy

Electricity consumption is set to explode, tripling by 2030, according to research by Boston Consulting Group. While the United States has a slim lead over China in the AI race, China dominates the AI energy race. Today, China has 3x the electricity production capacity (~3 terawatts vs 1tw). By 2050, China anticipates that it will nearly triple its capacity to 8.7 tws vs ~2 in the United States. Meanwhile, China’s energy is much more efficient, and it has 26 nuclear reactors under construction with plans to add hundreds more. The Trump administration has said winning the AI race is imperative to national security.

Without energy, the AI race is automatically lost. In my view, the most certain and juiciest risk/reward proposition lies in powering the AI revolution.

2 Ways to Play the AI Energy Boom

Nuclear can Power AI

Oklo OKLO – Free Report) ) is a company that develops small fission nuclear reactors that provide clean and reliable energy. Shares jumped more than 10% in a single session recently after reports surfaced suggesting that the White House is considering an executive action to speed up the development of nuclear reactors.

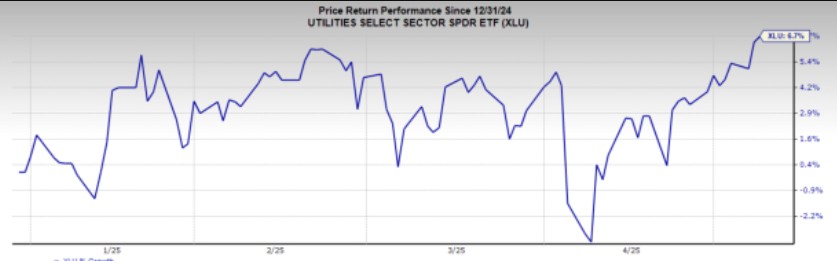

Utilities Benefit from AI Buildout

The Utilities Select Sector SPDR ETF XLU – Free Report) ) is the optimal way to profit from AI energy needs diversely. While US markets have been pummeled thus far in 2025, XLU exhibits stellar relative price strength and is nearing 52-week highs.

Bottom Line

Whoever wins the AI war between China and US will dominate the world economy. While the US has a slim lead in AI, China has the edge when it comes to energy – and the US will need to play catchup (and fast).

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.9% per year. So be sure to give these hand picked 7 your immediate attention.

More Zacks.com