Why the technology sector just ended its worst week since early September.

The S&P 500’s technology sector just ended its worst week since early September, after Chinese artificial-intelligence company DeepSeek seemed to startle investors’ perception of winners and losers in the stock market’s AI craze.

The S&P 500

SPX

and Nasdaq Composite

COMP

closed Friday with weekly losses, dragged down by battered tech stocks after fears surrounding DeepSeek suddenly surfaced in the U.S. equities market. AI chip maker Nvidia Corp.

NVDA

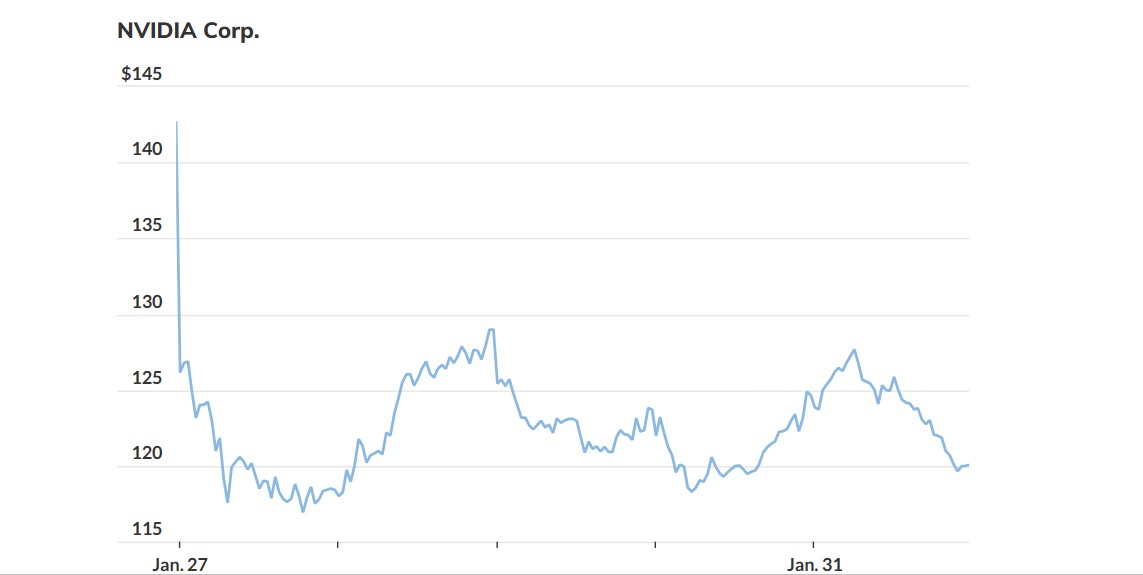

lost $552 billion in market value this week through Friday, after its stock struggled to rebound from a 17% plunge on Monday.

“Nobody saw DeepSeek coming and doing the same thing” as OpenAI, but with what looked like cheaper, less powerful chips, said Rob Arnott, founder and chairman of Research Affiliates, in a phone interview Friday.

It’s not that investors thought startup DeepSeek was going “to blow OpenAI and Microsoft and Google out of the water,” he said, but it called into question “how big a moat” companies like Nvidia, OpenAI and Microsoft Corp.

MSFT

have to protect against their competition.

Big Tech stocks have benefitted from investor optimism that generative AI will bring about stronger corporate profits and productivity in the U.S. economy. Semiconductor company Nvidia has soared over the past couple years on expectations for massive spending on its AI chips by deep-pocketed Big Tech companies like Microsoft and Facebook parent Meta Platforms Inc.

META

“Bubbles are fueled by narratives,” Arnott warned. “Disrupters get disrupted shockingly fast.”

While the narrative that AI is going to be “huge” and “change the world” may be true, the winners and losers may not be the same ones perceived today, he said. The worry now — as during the dot-com bubble in the late 1990s, when the internet was seen as changing everything — is that those narratives are already reflected in stock prices, according to Arnott.

Read: AI hype around ‘Magnificent 7’ stocks is latest example of ‘big market delusion’

“The ‘picks and shovels’ segment of the AI stack — Nvidia, for example — has been the early winner thus far,” Research Affiliates said in a report earlier this week. “But the true champions — the Googles and Apples of the AI boom — will be those firms that develop the yet-to-emerge ‘killer apps.’”

The S&P 500 — a capitalization-weighted index of U.S. large-cap stocks heavily concentrated in a small group of Big Tech companies as a result of their huge market values — has skyrocketed over the past couple years. Such megacap stocks, including Apple Inc.

AAPL

, Microsoft, Nvidia, Amazon.com Inc.

AMZN

, Google parent Alphabet Inc.

GOOGL

GOOG

, Meta and Tesla Inc.

TSLA

, have fueled the S&P 500’s climb since the current bull market began more than two years ago.

Big 4 capex plans remain solid despite lower-cost models like DeepSeek’s,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, in a note Friday. “With a strong AI outlook from both Microsoft and Meta, we still expect the combined capital spending by the Big 4 tech companies (Alphabet, Amazon, Meta, Microsoft) to rise 25% this year” to $280 billion, she wrote, calling that “a positive for the AI compute industry.”

Arnott favors a value-investing approach using the Research Affiliates Fundamental Index to stay diversified in stocks across sectors. The index provides exposure to the largest companies in the U.S., including popular Big Tech stocks, but it weights them based on fundamental metrics such as cash flow, dividends and book value — not by their market capitalizations, in contrast to the S&P 500.

“If investors want a margin of safety,” they should not have all their money in the S&P 500 due to its heavy dominance by Big Tech stocks known as the ‘Magnificent Seven,’” said Arnott. “The warning from the dot-com bubble is a sobering one,” he said, explaining that none of the top 10 tech names at the time outperformed over the next 15 years.

“That’s a long time to wait,” he said. The “danger” for investors is that although AI-related businesses may “perform brilliantly,” that may not be enough “to hold up the price” of their stocks.

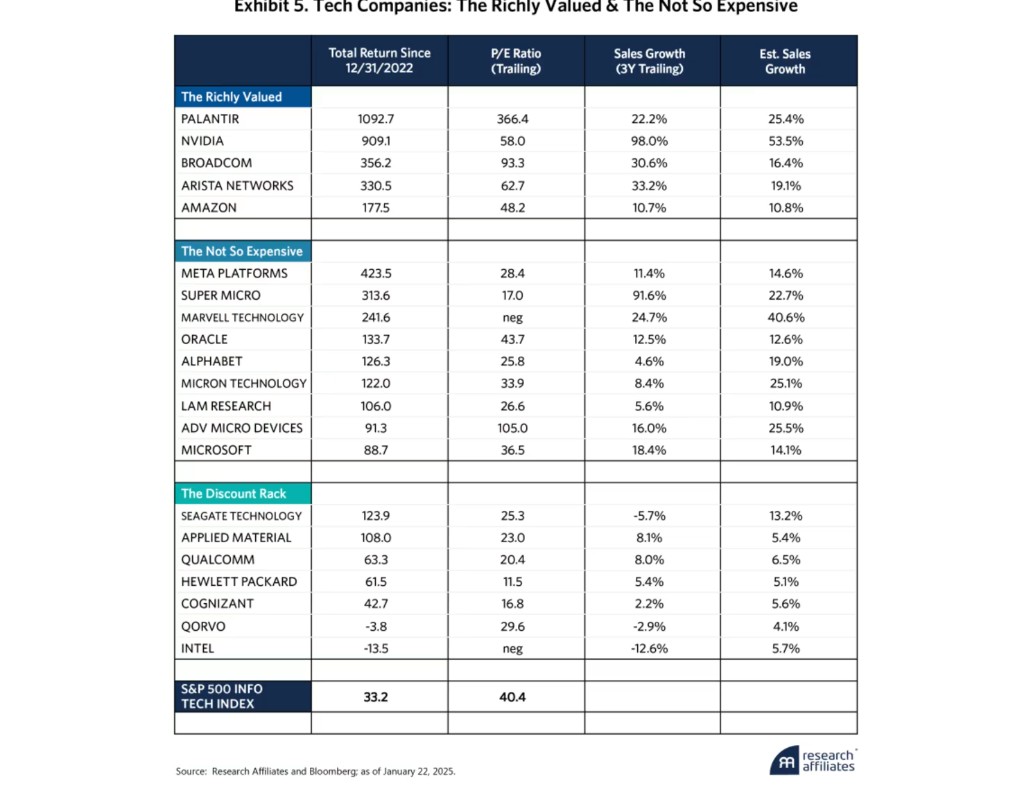

AI mania has driven up some tech-oriented stocks, including Nvidia, to lofty prices that are “richly” valued, according to Research Affiliates, citing data as of Jan. 22 in the table below. Others are “not so expensive,” and some may be found on the “discount rack,” the table shows.