The group is also undertaking feasibility studies for mini mills in Raahe and Luleå (above). In Q3, 2022 saw Volvo Trucks begin investment in heavy electric trucks made from SSAB fossil-free steel

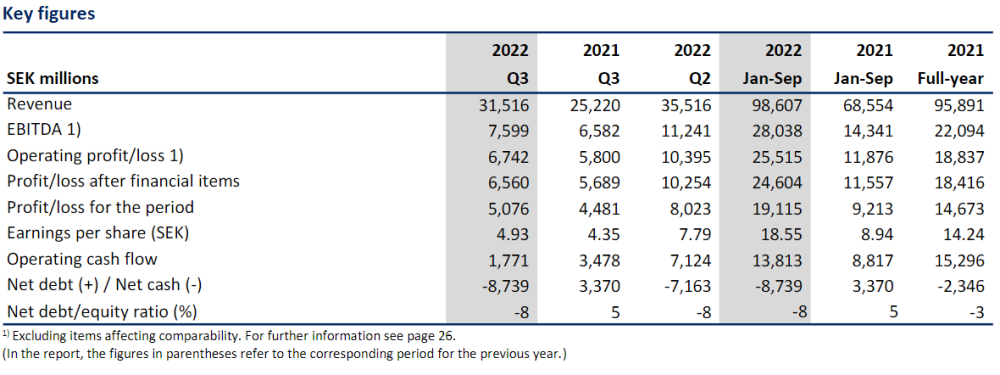

SSAB’s operating profit during Q3, 2022 rose compared to the same period in 2021, despite a weak European market. This was supported by a strong performance from both SSAB Special Steels and SSAB Americas divisions.

The company succeeded in partnering with a US speciality trucks manufacturer, making it the first fossil-free steel deal in the American market.

This strengthens SSAB’s position as one of the leaders in transitioning the global steel industry to a more sustainable model and helps towards achieving its 2030 green steel products target.

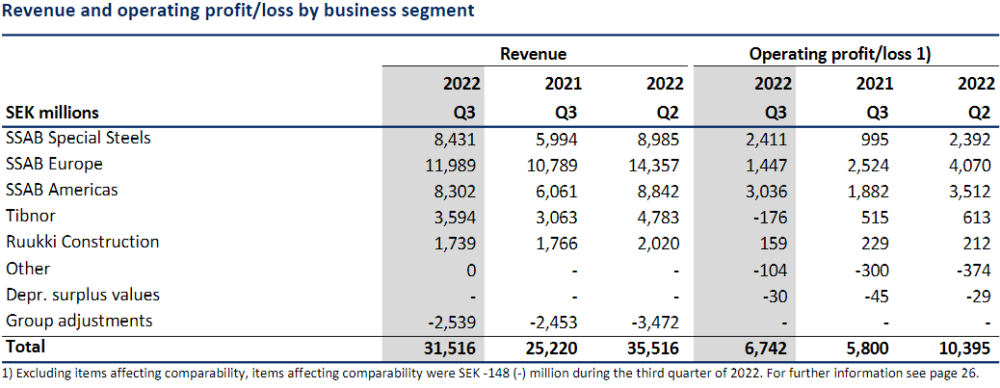

SSAB Special Steels’ operating profit increased to SEK 2,411 million for the quarter, up from SEK 995 million in Q3, 2021. The operating margin rose to 28.6% (16.6% – Q3, 2021).

SSAB Europe’s operating profit for the third quarter dropped to SEK 1,447 million from SEK 2,524 million for the same period last year. The operating margin also was down to 12.1% (23.4% – Q3, 2021).

SSAB America’s operating profit increased to SEK 3,036 million (SEK 1,882 million – Q3, 2021) and the operating margin rose to 36.6% (31.1% – Q3, 2021).

An important health and safety metric for the steel industry is Lost Time Injury Frequency (LTIF), which SSAB’s group policies and procedures managed to lower to 1.15 (1.90 – Q3, 2021).

Steel market projections

SSAB has lowered its projected steel production volumes due to the weakness in the European market. It has chosen to bring forward scheduled maintenance at its Raahe blast furnaces to reduce capacity, beginning in November 2022.

The group is also undertaking feasibility studies for mini mills in Raahe and Luleå. In Q3, 2022 saw Volvo Trucks begin investment in heavy electric trucks made from SSAB fossil-free steel.

SSAB’s Special Steels and SSAB Americas divisions’ projections remain steady as demand for fossil-free steels continues to rise, while a partnership with American truck specialist Oshkosh Corporation will see the development of commercial vehicles manufactured with SSAB’s fossil-free steel.

The company’s drive for full fossil-free steel production by 2030 needs there to be much greater availability of green electricity, which is also key to providing a level playing field across Europe regarding state aid for the transition to, and achievement of, zero carbon goals.

SSAB Q4, 2022 outlook

The European market is expected to remain weak into the new year, as the spectre of rising inflation, shortages of components and the continued risks from global conflicts, including the war in Ukraine, cast a heavy shadow on the future of global steel markets.

Steel prices, as well as a lower volume of shipments of SSAB Special Steels (due to a maintenance outage in Oxelösund) will be soft as compared with Q3, 2022. Steel shipments from SSAB Americas are expected to rise as the planned maintenance outage in Q2, 2022 has been carried out, and production levels are normal.

However, while the US heavy plate market remains relatively stable, prices are expected to fall, even though costs for raw materials in Q4, 2022 will remain competitive.

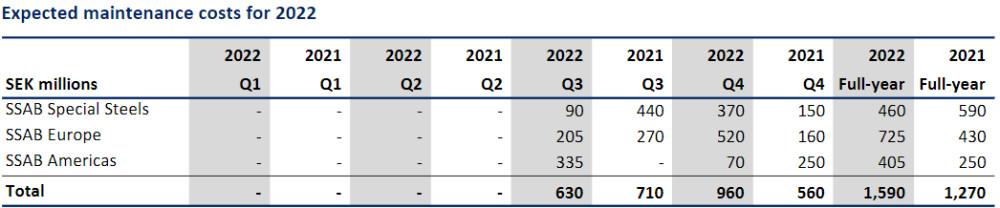

Planned outages for maintenance in 2022

Maintenance costs for 2022 for SSAB Group are expected to rise to SEK 1,590 million, higher than the previous forecast of SEK 1,210 million, as Raahe’s blast furnace maintenance has been moved up to November 2022, as previously stated. The overall increase in prices for goods and services across the world is another factor for the higher costs.

The state of the steel industry in Q3, 2022

There was strong demand for high-strength steel in most markets, but demand in Europe fell owing to a softer-than-expected economic outlook, while China’s demands dropped due to various closures during its many lockdowns.

Inventory held by stockists and distributors, and exports to European customers were reasonably high during the period, but pricing dropped across the region, more in heavy plate than strip.

Demand for heavy plate products was healthy in the US owing to softer pricing, but inventory levels were low owing to planned maintenance in Q2, 2022.

Revenue and operating profit details

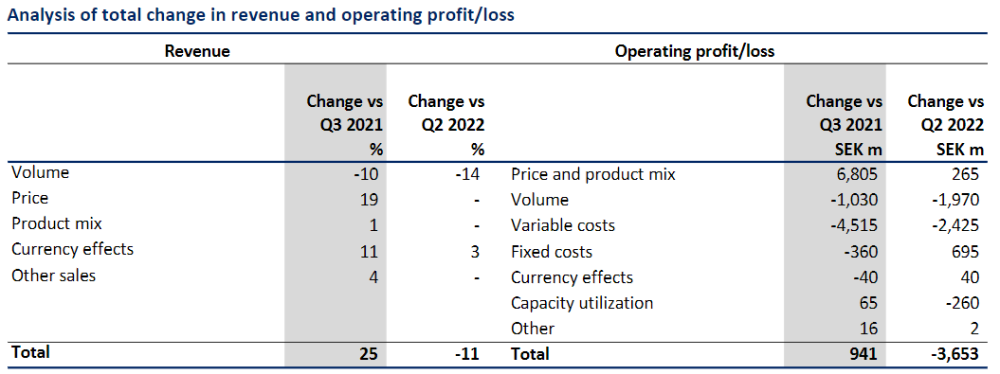

Revenue for Q3, 2022 was SEK 31,516 million (SEK 25,220 million – Q3, 2021), up 25% compared to the third quarter of 2021, off the back of higher global steel prices; revenue was down 11% against Q2, 2022.

Operating profit was SEK 6,742 million (SEK 5,800 million – Q3, 2021), again due to higher prices.

The tables below detail how divisions performed, and revenue and operating profit followed by the total change in revenue and operating profit.

Fossil-free steel production target

In contrast to direct reduced iron (DRI) produced using a fossil-based reducing gas, such as natural gas, recent test results from the HYBRIT pilot plant in October 2022 showed that DRI with hydrogen produces a product with superior mechanical and ageing qualities. Applications for patents have been submitted to the European Patent Office by HYBRIT Development AB.

SSAB’s stated target date for fossil-free steel production is 2030, but this transformation requires a significant supply of green electricity. The application for two 130 kV electricity lines to the SSAB steel factory in Oxelösund was accepted by the Swedish Energy Markets Inspectorate in October. The application and its subsequent decision may be challenged.

By: Verdict Media Limited 2022