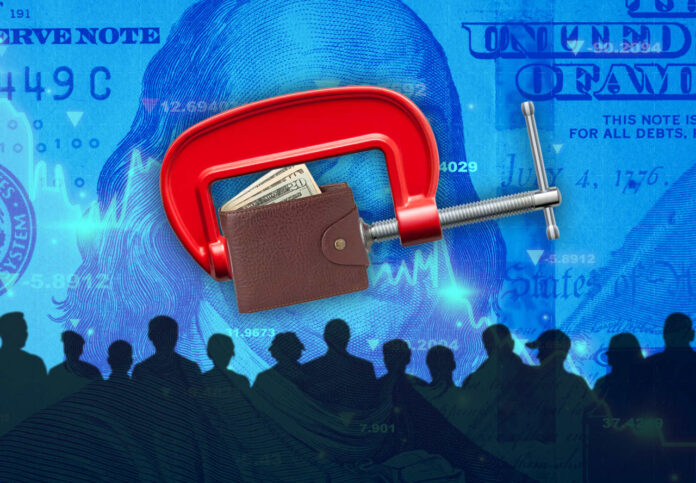

Middle-income Americans, many of whom continue to struggle with elevated prices following the pandemic recovery, could face more inflation and a tight job market in 2025 — increasing pressure on a group that is already financially spread thin.

So-called revenge spending by high-income Americans helped the U.S. economy grow by at least 2.5% and dodge a downturn this year. Yet the situation for low- to middle-income consumers is at risk of worsening next year as the labor market shows some signs of weakening and proposals by President-elect Donald Trump are projected to increase prices and reduce economic growth, some analysts say.

J.P. Morgan analyst Matthew Boss colloquially described low- to middle-income consumers as being in a “selective recession” earlier this year, meaning they are under financial pressure due to rising prices, which took an incremental toll on their savings. A recession formally refers to a “significant decline in economic activity” that lasts more than a few months, according to the National Bureau of Economic Research. Boss was not available for an interview.

“There are many people in the middle class who are not in their ideal circumstances,” Columbia Business School professor Brett House told MarketWatch. While House did not go as far as to characterize the middle class as being in a recession, he said the increase in the cost of living and in interest rates over the last few years “has not fallen on people in an equitable or equal way.”

Trump’s major policy proposals “would be unlikely to make middle-class Americans better off,” House added. Tariffs, reduced immigration levels and mass deportation, for instance, would “unquestionably push up costs” for businesses and “increase the prices that Americans pay for essential goods,” he said.

The share of Americans in middle-income households, as well as the percent of total household income they held, had already been in decline for decades before the pandemic, according to the Pew Research Center. During the pandemic recovery, middle-income households saw the slowest wage growth among all groups between 2019 and 2023, according to data from the Economic Policy Institute, a left-leaning think tank.

By 2024, consumption became “dominated by high-income households, which have enjoyed enormous gains in household wealth, along with strong interest, dividend and property income,” J.P. Morgan analysts wrote in a 2025 year-ahead report. Other consumers, in the meantime, have been more cautious.

Historically, middle-income consumer sentiment tracked that of high-income Americans, Kayla Bruun, lead economist at the polling firm Morning Consult, told MarketWatch. But when inflation heated up in 2021, the gap in financial well-being between high-income consumers and everyone else started widening. Middle-income consumers were able to cope with rising prices for a while, but “starting in late 2023 and the first half of this year, the middle-income group really started to deteriorate and behave more like lower-income consumers,” she said.

More Marketwatch

By Marketwatch