President Javier Milei: Sunday’s midterms winning

Argentina has spoken and Javier Milei has reason to celebrate. His party defied predictions in Sunday’s midterms, winning a larger share of seats in Congress and solidifying his mandate for sweeping economic change. The victory comes just after a high-stakes U.S. intervention to shore up the peso, a move tied to President Donald Trump’s support for Milei’s radical, inflation-fighting program. So what’s next for Milei and for investors watching Argentina’s volatile markets? Our analysts break it down below.

- Alejo Czerwonko: Member of the Adrienne Arsht Latin America Center’s Advisory Council and the managing director and chief investment officer emerging markets Americas for UBS Global Wealth Management

- Jason Marczak (@jmarczak): Vice president and senior director of the Adrienne Arsht Latin America Center

- Valentina Sader (@valentinasader): Deputy director at the Adrienne Arsht Latin America Center

- Martin Mühleisen (@muhleisen): Nonresident senior fellow at the GeoEconomics Center and former International Monetary Fund official

Behind the results

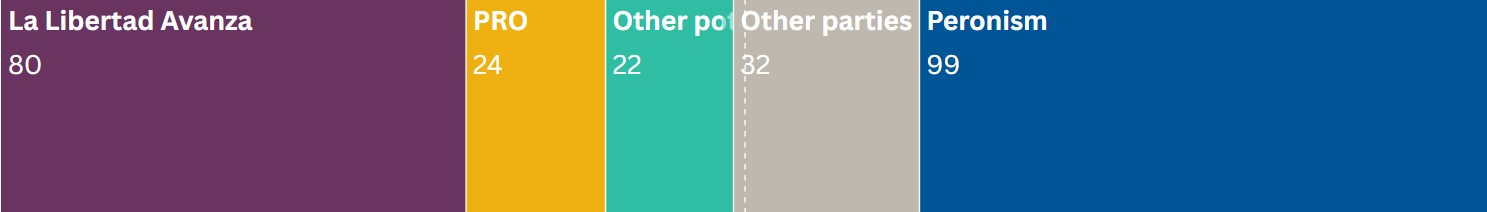

- Milei’s party, La Libertad Avanza (LLA), captured more than 40 percent of the vote, more than doubling its share of seats in Congress. “The scale of Milei’s victory sits at the most optimistic end of pre-election expectations,” Alejo tells us. “His party now holds the political capital needed to accelerate structural reforms.”

- Jason notes that the “most surprising” result was LLA’s narrow win over the rival Peronist party in Buenos Aires Province, “where, less than two months ago, a 14-percentage-point loss in provincial elections rattled markets” and seemed to portend a poor midterm result for Milei.

- One factor that “likely figured into the size of LLA’s victory,” Jason says, was the backing of the Trump administration, via a twenty-billion-dollar currency swap line and another twenty-billion-dollar loan instrument that could be used to purchase Argentine debt. Sunday’s results, Jason adds, “will give reassurances to the US administration of its backing of Milei’s economic reforms.”

- But Jason points out “one notable and concerning sign” coming out of the elections. Voter turnout was only 67.9 percent, “the lowest since the county’s return to democracy,” Jason notes.

- Still, Valentina says Argentines gave Milei a vote of confidence: “This electoral outcome is a clear answer to those questioning the political viability of Milei’s plan and the willingness of the Argentine people to endure the pain of some of these reforms.”

- Source: Based on estimates from La Nacion • La Libertad Avanza is president Milei’s coalition. PRO, the center-right party led by former president Macri, is the government’s main ally. The category “Other potential allies” includes the groups Provincias Unidas, UCR, and Encuentro Federal. The category “Other parties” includes the UCR Disidente, FIT, and others.

- Argentina’s bond markets had been wobbly in recent weeks as Milei’s political fortunes seemed to suffer. But now, Martin tells us, “Markets are likely to swing strongly in Argentina’s favor over the coming days, boosting the exchange rate and allowing the government to resume the accumulation of foreign exchange reserves, and interest rates should also decline markedly.”

- Alejo notes that “Argentina’s ‘country risk’—the spread its US dollar sovereign bonds pay over US Treasuries—was at distressed levels” before the election, with investors expecting a poor LLA performance. But “Argentine risk assets should now benefit from greater political stability, a renewed push for pro-market reforms, and robust support from the US.”

Milei’s checklist

- So what will the next phase of Milei’s reforms look like? Alejo predicts “an ambitious deregulation agenda,” along with “labor, tax, and potentially social security reforms” and changes to Argentina’s foreign exchange policies.

- While Argentina could allow for some meaningful depreciation in the days ahead, Martin expects the government to “still be hesitant to float the peso—meaning allow it to move with the market—for good, which would be necessary for the exchange rate to find a more stable long-term equilibrium.”

- Martin notes that while LLA does not have an outright majority in Congress, it will have an easier time building legislative majorities for certain policy moves and blocking any big spending plans. He advises Milei to “use this political and economic window of opportunity” to advance the “structural transformation of the economy” and ensure that promises lead to results for growth and jobs.

- After all, Martin says, Argentina still has a long way to go to remove the vestiges of Peronism from its economy, starting with labor market rigidities and a large pension cost overhang.

- The midterm result suggests Milei has a strong chance of re-election in two years, which won’t be lost on lawmakers. “Success breeds success,” Martin says. It is this dynamic that should work in Milei’s favor while he continues on his difficult and often painful reform path.