[ad_1]

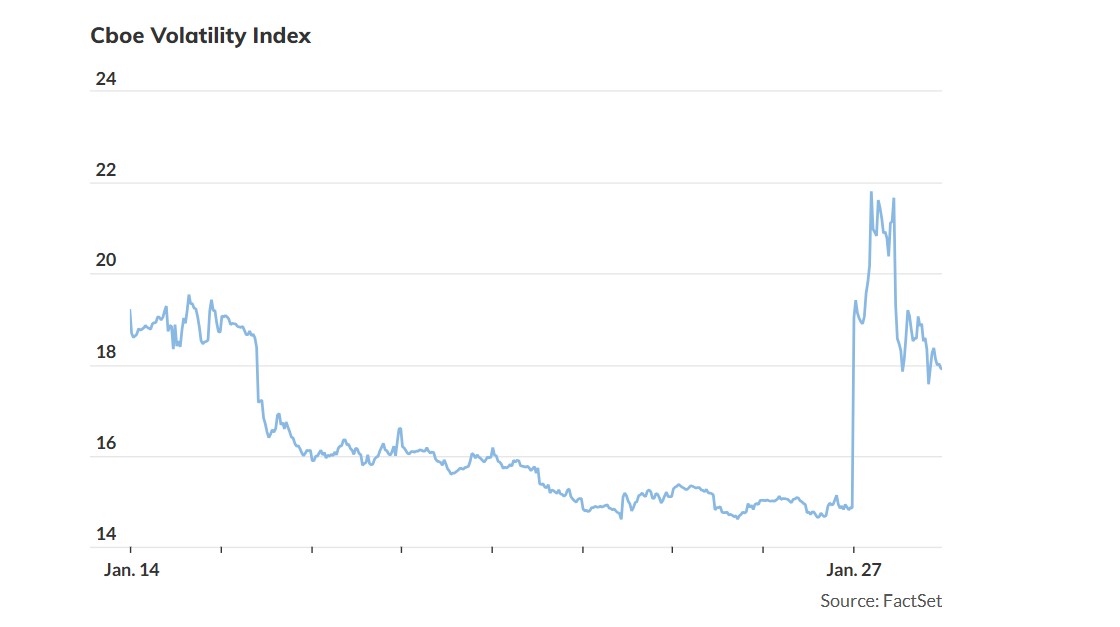

U.S. stocks mostly sold off Monday, amid fears China’s AI company DeepSeek could disrupt profits for Big Tech stocks.

Major U.S. stock indexes mostly sold off Monday, as fears that China’s artificial-intelligence startup DeepSeek could disrupt profits for Big Tech companies spooked investors already worried about their high valuations.

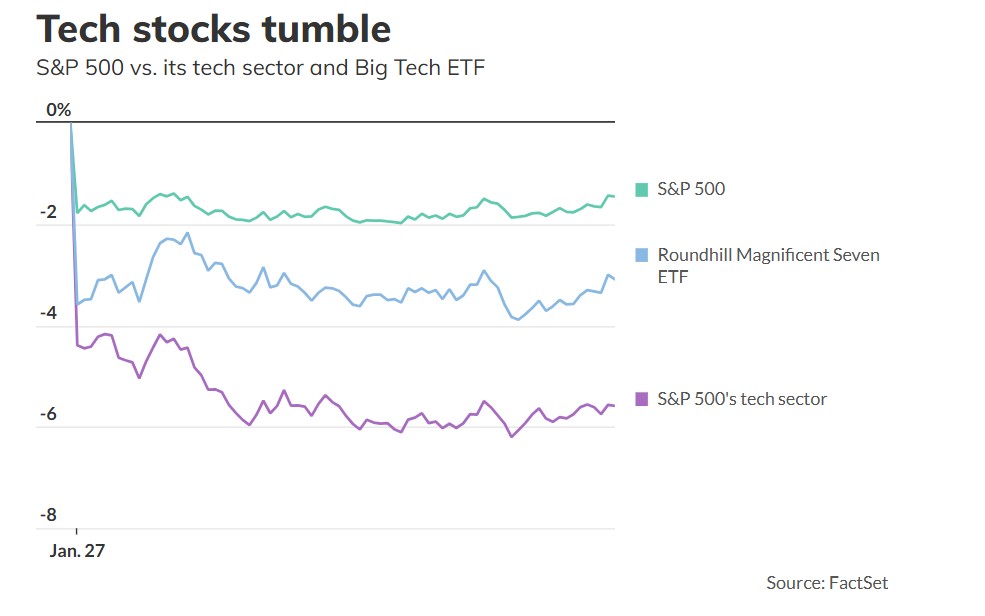

While Big Tech stocks propelled the S&P 500 to a big rally last year as investors cheered developments in AI, the bull run also left investors concerned that their concentration in the widely followed U.S. equities index made it vulnerable to a selloff.

The S&P 500

SPX

finished Monday 1.5% lower, while the technology-heavy Nasdaq Composite

COMP

dropped 3.1% and the Dow Jones Industrial Average rose 0.7%. The Roundhill Magnificent Seven ETF

MAGS

— which holds seven closely followed Big Tech stocks including Nvidia Corp.

NVDA

, Microsoft Corp.

MSFT

, Apple Inc.

AAPL

, Google parent Alphabet Inc.

GOOGL

, Amazon.com Inc.

AMZN

, Tesla Inc.

TSLA

and Facebook parent Meta Platforms Inc.

META

— slumped 3.1% Monday.

Clearly the index is being dragged down by a handful of names,” said Kevin Gordon, senior investment strategist at Charles Schwab, in a phone interview Monday. Market worries over DeepSeek created a “trigger moment” for investors who worried they were too exposed to U.S. tech, as the market has been “quite frothy” from a behavioral standpoint, he said.

“Given the runup in markets over the past two years, it is well worth considering valuations in markets and concentration in portfolios,” David Kelly, chief global strategist at J.P. Morgan Asset Management, said in a note emailed Monday. “When the dot-com bubble burst in March of 2000, the S&P 500 fell by 47% over a two-and-a-half-year period and was still down by 21% two years after the trough.”

As recently as Jan. 23, “the S&P 500 was selling at 22 times forward earnings, 1.6 standard deviations above its 30-year average,” said Kelly. And “the top 10 stocks within the index were sporting a forward P/E of over 30 times,” he wrote, referring to the price-to-earnings ratio.

The S&P 500, a gauge of U.S. large-cap stocks, notched a record closing high of 6,118.71 on Jan. 23, according to Dow Jones Market Data.

Big Tech stocks have massive market values, translating into outsize weighting in the S&P 500 index.

Stifel’s chief equity strategist, Barry Bannister, cautioned in a note Sunday that “valuation only matters at extremes, and large-cap U.S. stock indices are now well into the 5th ‘mania’ in 100+ years.”

Shares of AI-chip maker Nvidia plummeted 17% Monday. Even with that steep selloff, Nvidia has gained around 94% over the past 12 months, according to FactSet data.

the S&P 500’s price-to-earnings ratio has “peaked as signs indicate,” then the outperformance of large-cap growth relative to value equities also has topped, said Bannister.

Investors’ excitement around U.S. large-cap growth stocks is also reflected in the runup of the Nasdaq Composite, which last year jumped 28.6% after surging 43.4% in 2023, according to FactSet data. The S&P 500, whose biggest sector is information technology, rallied 23.3% last year, building on its 24.2% gain in 2023.

Although some investors expect a smooth hand-off from Growth to Value,” wrote Bannister, history and our economic views suggest otherwise.

Value stocks outperform Monday

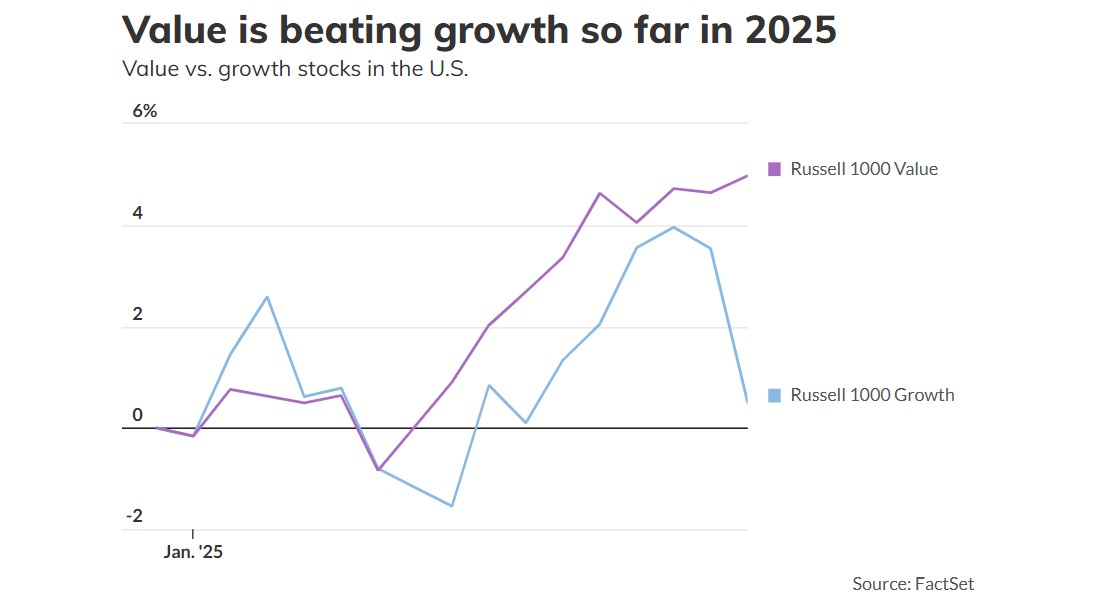

Value stocks fared much better than growth stocks during Monday’s selloff.

The Russell 1000 Value Index

RLV

closed 0.3% higher Monday, while the Russell 1000 Growth index

RLG

slid 2.9%, according to FactSet data.

Some “value sectors” may outperform this year, said Gordon. As long as the labor market and economy remain strong, that “creates solid ground for value to catch back up to growth,” he said, after growth stocks surged last year to crush value.

Tumbling tech stocks in the S&P 500 made it the index’s worst-performing sector

SP500.45

-5.58%

on Monday — by far — with a 5.6% loss. That marked the tech sector’s worst day since September 2020, according to Dow Jones Market Data.

The S&P 500’s drop Monday was “not as severe as the headline index would suggest,” said Gordon. The market’s breadth appeared “relatively healthy,” he said, as more stocks rose in the S&P 500 on Monday than fell.

Still, across major exchanges, U.S.-listed stocks lost roughly $1 trillion in value Monday as tech struggled, according to Dow Jones Market Data.

Although Big Tech cyclical growth stocks have dominated the S&P 500 amid 2025’s “euphoria,” Bannister anticipates “defensive value” may outperform on expectations for weaker gross domestic product in the second half this year “in tandem with sticky inflation.”

Examples of defensive value in the equities market include utilities, pharmaceuticals, biotech and life sciences, healthcare equipment and services, household products and commercial and professional services such as “waste stocks,” according to his note.

While utilities are traditionally seen as a defensive sector, they also have been viewed as a beneficiary of artificial intelligence due to the increased power that investors have expected generative AI would require.

The S&P 500’s utility sector

SP500.55

-2.33%

closed 2.3% lower Monday, the second-worst-performing sector in the index after tech, according to FactSet data. The S&P 500’s sectors finished mixed Monday, with consumer staples, healthcare and financials and real estate all posting sharp gains. Consumer staples, a defensive area of the stock market, led sector gains, ending Monday up around 2.9%, according to FactSet data.

The Invesco S&P 500 Equal Weight ETF

RSP

+0.07%

, an exchange-traded fund that equally weights stocks in the S&P 500, ended Monday up 0.1%.

Investors will be watching closely this week for Big Tech companies to begin reporting their quarterly earnings, with results from Microsoft, Meta and Tesla due out on Wednesday. That’s the same day as the highly anticipated outcome of the Federal Reserve’s monetary policy meeting.

Bannister cautioned that beyond investor exuberance for U.S. large-cap stocks, “a mild case” of stagflation later this year also risks contributing to a potential S&P 500 correction of around 10% this year to around 5,500. The index closed Friday at 6,101.24.

If the Mag-7 disappoint, they could drag the S&P 500 down significantly since they account for a whopping 30.5% of the market cap of the index,” warned Yardeni Research in a note Sunday. “They also account for a hefty 21.6% of the forward earnings of the S&P 500.