[ad_1]

The U.S. stock market may start the new year with a hangover if trouble doesn’t cause headaches before then. Here are three reasons why, and how you should prepare for it.

1. Insiders don’t like this market: An insider sell/buy ratio tracked by Smart Insider was recently at 3.0. That does not bode well for the stock market. “It almost never gets as high as it is now,” Smart Insider head of research Bill Lattimer said in a recent interview. “We consider it bearish when it is over two. The last time insiders were this cautious was in early 2021.” The next year saw a bear market.

The good news is that a lot of the selling is by insiders getting rid of stock into strong price gains. “It is not clear if they think something bad is going to happen in the economy, or they are being opportunistic and taking advantage of higher stock prices,” Lattimer says. The heaviest insider selling currently is in technology, consumer discretionary and bank stocks. Sectors that look the best are pharmaceuticals, biotech and medical equipment.

The bottom line: The stock market can have a hard time moving higher when insiders are so cautious. Their concern may set the market up for a pullback.

2. Investors seem too bullish: Extreme investor bullishness is a negative in the contrarian sense. Most often the crowd gets it wrong, so it pays to bet against them. Being cautious now because of the widespread bullishness is the opposite of being bullish because of extreme negative sentiment.

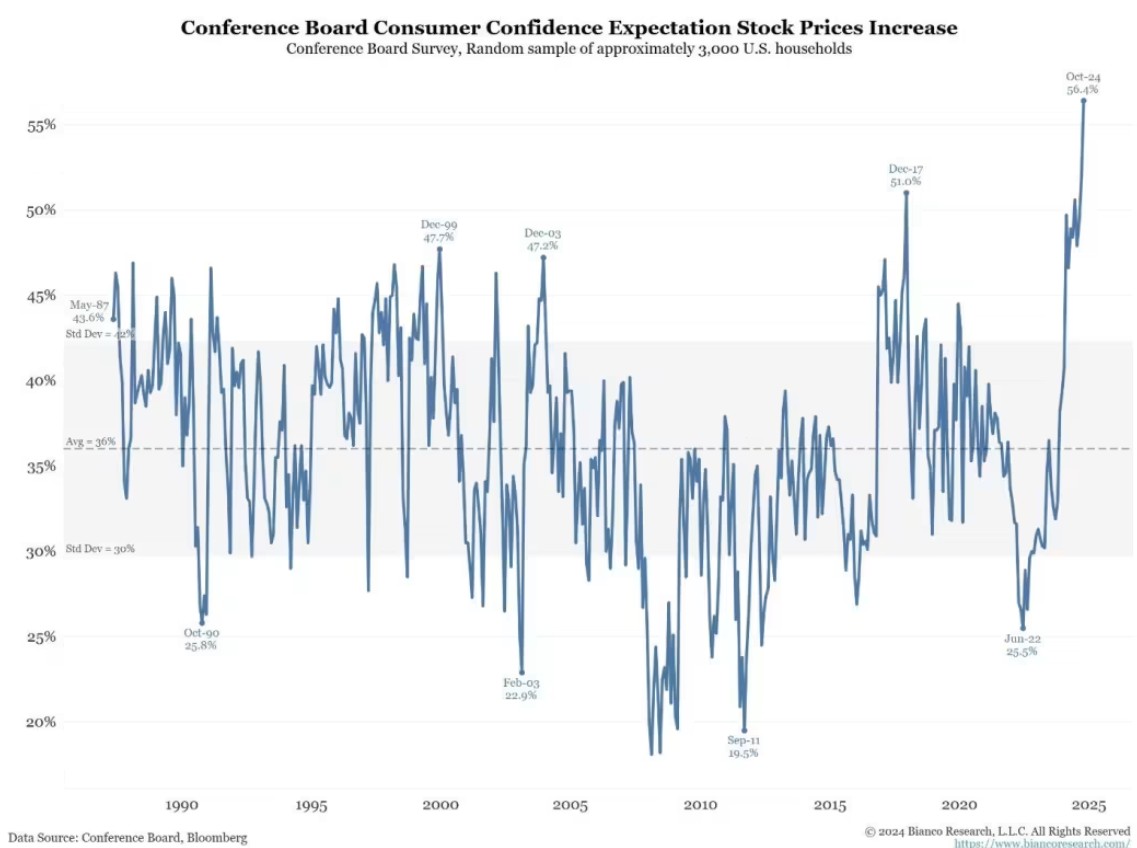

Among the signs of excessive bullishness is a recent Conference Board survey of consumer stock market expectations, which shows 56.4% think the market will go higher from here. Remarkably, consumers are more bullish on stocks now than they have ever been since the 1990s. Here is a chart from Bianco Research.

Moreover, the Investors Intelligence Bull/Bear ratio came in at 3.8 this week. Anything near or above 4.0 is a cautious signal, according to how I use this gauge. You can see in the chart below from Yardeni Research that the bull/bear ratio does not normally stay up in the 4.0 zone for long. Often selling ensues, which makes investors more cautious, bringing this ratio down.

More MarketWatch

Prepare now for stocks to sell off at the start of 2025.[ad_2]